Money may make the world go round, but man, do we hate talking about it â especially when our approach to spending and saving doesnât match our partnerâs.

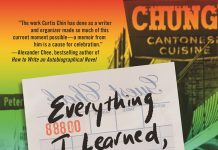

For those couples looking to work through their fiscal philosophy differences, Scott Rick, a marketing professor at the , has published a new book called . Filled with insights gleaned from behavioral science, the book is packed with guidance about navigating financial squabbles and was inspired by Rickâs own experience.

âI married a tightwad,â says Rick, a self-proclaimed spendthrift. âWe were a blind date. [My wife] Julie was probably charmed by my very different, quirky, carefree approach to spending. ⊠And I was quite amused by her reluctance. Like, âWhat are you talking about? You can afford that. Thatâs silly.â It probably was one of the aspects that we enjoyed about each other.â

As the book explores, this âopposites attractâ principle may stem from the idea that spendthrifts and tightwads often understand, on some level, that their relationship to money isnât ideal, so they might be drawn to someone whoâs completely different. (And if youâre not sure where you fall on the spectrum, thereâs a handy Tightwad-Spendthrift Scale in the bookâs introduction.)

Yet even those who land in the âunconflicted consumerâ middle of the scale will likely have occasional dustups with a partner over money.

Why is the topic so uncomfortable to discuss?

âA lot of us have been convinced that small purchases matter more than they do,â Rick says. âThat if you could just pack your lunch and avoid buying a latte, we could become rich. Thatâs what weâre told by the most prominent financial experts out there. But the logic defies any math that Iâm aware of. So, I think thereâs a lot of unnecessary friction over the small stuff.â

To solve this in his own marriage, Rick has a joint account with his wife, but they also each have individual accounts, and they funnel money into them on an as-needed basis.

âIt works for us,â Rick says. âI have a sense of what my wife spends, and she has a sense of what I spend, but the details â I donât think either of us would benefit from knowing the details, because we have different interests and hobbies, and the prices would just seem too shocking. But itâs important to have some individuality and to enjoy your own pursuits and not feel like someone is looking over your shoulder.â

Rick also suggests, in his book, small changes that can impact your spending habits, like a tightwad using apps and credit cards to make transactions less tangible and painful, and spendthrifts aiming to use physical (i.e., less abstract) money more often. However, the growing trend of âcashlessâ theme and sports parks, automatic payments, and other forms of frictionless spending has been making the latter adjustment more challenging.

âItâs an interesting feeling to hand a child an Amex and say, âOK, well, just take it easy on this,ââ Rick says. âMy kids, at least, do not understand that that card I was always pulling out at Target was attached to money. And how would they know?â

Other chapters in Rickâs book offer useful tips for better gift giving (heads up, bad gifters!) and explore whether kids inherit their parentsâ money habits as they become adults.

âThose of us who are on the extremes â weâre not wanting to reproduce this pattern in our kids,â Rick says. âSo weâre telling them, âDo as I say, not as I do.â But they see what we do. ⊠And we eventually revert to what we grew up with. I think there is this stickiness across generations. Change is possible, but itâs very slow moving. ⊠And itâs not like we all grow up with openness around money at home, usually, or people modeling how to have reasonable discussions about this kind of thing.â

Perhaps not â but maybe Rickâs book will get some of those conversations started.

This story is from the February 2024 issue of Âé¶č·ŹșĆ Detroit magazine. Read more in our digital edition.

|

| Ìę |

|